Companies and business personnel who deal with foreign partners, collect foreign currency for exported goods, or, conversely, pay for imported goods in foreign currencies, are at risk of loss due to the movement of foreign exchange rates. Such changes can ultimately result in significant or even complete loss of operating profits (for example, if exchange rate losses exceed business margins). As a result, a company’s competitiveness may be significantly weakened or further operations may be jeopardized.

A simple solution to eliminate exchange rate risks are exchange rate hedging instruments.

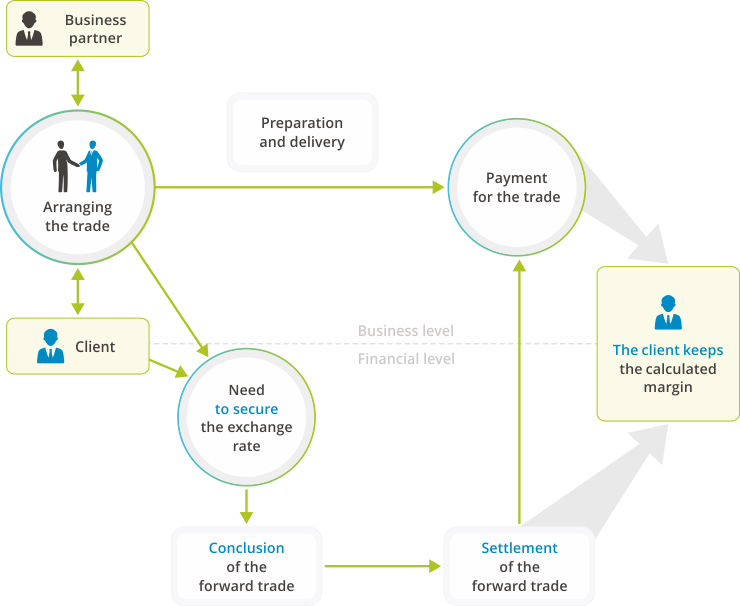

The primary function of a forward is to ensure against unfavorable trends of the exchange rate of two currencies. A forward gives you the option to buy or sell a specific quantity or currency at an exchange rate set at the time of closing the deal, but with a settlement date in the future (up to 1 year standard, may be longer in individual cases).

With a forward you have the option to gain security and fix your business margin against losses from potential unfavorable exchange rate trends on the forex market.

Now we are able to set an exchange rate which you can use to exchange foreign currency in the future, up to a year in advance. You can thereby fix the exchange rate when calculating the value of a given trade.

Companies and entrepreneurs trading with international partners, receiving foreign payments for exported goods or making paying with foreign currency for imported goods are usually exposed to risk of loss in association with the exchange rate fluctuations of foreign currencies. A change in the exchange rate could result in a significant or even complete loss of operating profit for the company (the exchange rate loss may exceed the margin of the trade). This may result in the significant weakening of the competitiveness of the company itself or even put its future operation at risk.